is missouri a tax free state

You can register your new business online for the following tax types. Sales Tax Vendors Use Tax Consumers Use Tax.

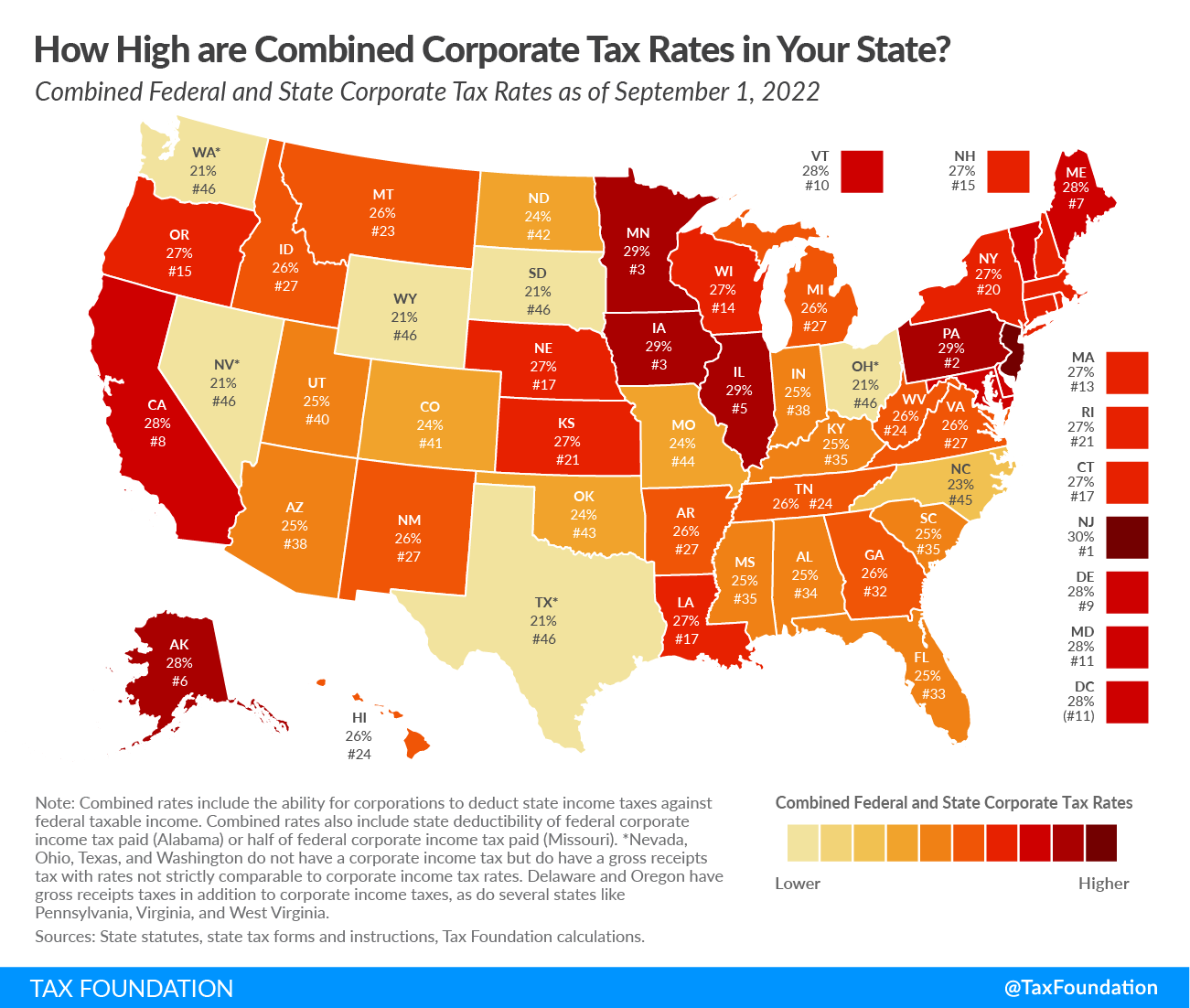

Missouri Tax Rates Rankings Missouri State Taxes Tax Foundation

Missouris tax system ranks.

. The Missouri Department of Revenue made a few changes for the 2021 tax year. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the. Missouris income tax system covers 11 tax brackets.

A new deduction has been added for contributions made to a long-term dignity savings account. Generally Missouri taxes all retail sales of tangible personal property and certain taxable services. Detailed Missouri state income tax rates and brackets are available on this page.

In 2019 the highest tax rate applied to annual income of more than 8424. File for free with taxact free file. Missouri has a progressive income tax system with income tax rates that range from 15 to 54.

Missouri has a 4225 percent state sales tax rate a max local sales tax rate of 5763 percent an average combined state and local sales tax rate of 829 percent. Anyone can shop without paying state and local sales taxes on included items during this time even if youre not. Feel free to contact the Department by email at.

The total state and local tax burden on Alaskans including income property sales and excise taxes is just 510 of personal income. Missouri recently lowered its top income tax rate from 54 to 53 for 2022 and its dropping again to 495 in 2023 with more rate reductions possible in the future. The federal income tax deduction allows Missouri taxpayers to deduct federal income taxes paid up to a limit of 5000 for single filers and 10000 for joint filers for tax.

15 on taxable income between 100 and 1000. The plan will cut. TAX DAY IS APRIL 17th.

However there are a number of exemptions and exclusions from Missouris sales and use tax. Start filing your tax return now. Alaska has no state income or sales tax.

Unlike the federal income tax missouris state income tax does not you may also electronically file your missouri tax return through a tax. No tax on the first 99 of income. Missouris tax-free weekend this year will be Aug.

Missouris latest tax cut will reward many residents with slightly lower tax bills in coming years with the states wealthiest residents seeing the largest returns. 2 on taxable income between.

State Tax Levels In The United States Wikiwand

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png)

States With Minimal Or No Sales Taxes

Where S My Refund Missouri H R Block

Is Living In A State With No Income Tax Better Or Worse Bankrate

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Missouri Budget Project State Tax Policy

Easterseals Midwest Missouri Tax Credits

Missouri Southern Offers Free Tax Assistance Koam

What You Need To Know About Missouri S Tax Free Weekend St Louis Business Journal

Missouri Retirement Tax Friendliness Smartasset

Missouri Car Sales Tax Calculator

Facial Tissues Film And Furniture What Isn T Sales Tax Free This Weekend Clayton Mo Patch

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Missouri Special Session On Tax Cuts Starts Wednesday

Sales Tax Laws By State Ultimate Guide For Business Owners

Missouri Income Tax Calculator Smartasset

Blevins Elementary The 2021 Missouri Tax Free Holiday Starts Today And It Runs Through Sunday Aug 8 Purchases Of Clothing School Supplies Computers And Certain Other Items Defined By State Statute Are

How Do State And Local Individual Income Taxes Work Tax Policy Center